Now the Pakistani nation has a great personal loan facility in a top Pakistani bank Muslim Commercial bank limited. The MCB Personal Loan scheme is the Fastest, most affordable, and most comfortable choice to adjoin your quick financing for everyone. Now you can get a loan in days with limited documents in a very short period.

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for a medical emergency, home renovation, or fulfilling any other personal desire, having a quick and reliable financial solution is crucial. MCB Personal Loan offers a fast, affordable, and easy option to meet your immediate financing needs. In this blog post, we will delve into the key features, eligibility criteria, and other important details of the MCB Personal Loan.

Key Features of MCB Personal Loan

MCB Personal Loan stands out with its customer-friendly features. Here’s what you need to know:

- Minimum Loan Amount: PKR 50,000

- Maximum Loan Amount: Up to PKR 2 Million

- Tenure: Flexible repayment options from 1 year to 4 years

- Collateral-Free: No collateral required for loan approval

- No Processing Fee: If the loan is not approved, you don’t pay a processing fee

- Approved Cities: The loan is available in multiple cities including Karachi, Lahore, Rawalpindi, Islamabad, and more.

Eligibility Criteria

To be eligible for the MCB Personal Loan, applicants must meet the following criteria:

- Salaried Individuals: This includes employees in the Private sector, the Government of Pakistan, and the Armed Forces.

- Credit History: Those who have previously taken a credit card, personal loan, or overdraft facility from any bank in Pakistan.

- Existing MCB Customers: Includes MCB Car4U customers (with a loan taken more than 1 year ago) and salaried customers whose salary has been credited in MCB for over a year.

Documentation Required

The initial documentation process is straightforward:

- Income Proof: Copy of Salary slip or other proof of income

- Identification: Copy of Valid CNIC

Interest Rates

Interest rates vary based on the customer’s credit history and are as follows:

| Tenure | Customers with Qualifying Credit History | Customers with a Non-Qualifying Credit History |

|---|---|---|

| 1 to 4 years | 1-Year KIBOR + 14% | 1-Year KIBOR + 16% |

*Note: Rates are subject to terms & conditions.

Approval and Discretion

- Approval Criteria: The bank has broadly defined eligibility criteria for approval.

- Bank’s Discretion: MCB Bank reserves the right to accept or reject any proposal based on its sole discretion and by regulations and the bank’s policies.

How to Apply

For more information or to apply for the MCB Personal Loan:

- Phone Banking: Call MCB Phone Banking at 111-000-622 (MCB Bank)

- Branch Visit: Visit your nearest MCB Bank branch

- Online Inquiry: Click here for online details and application

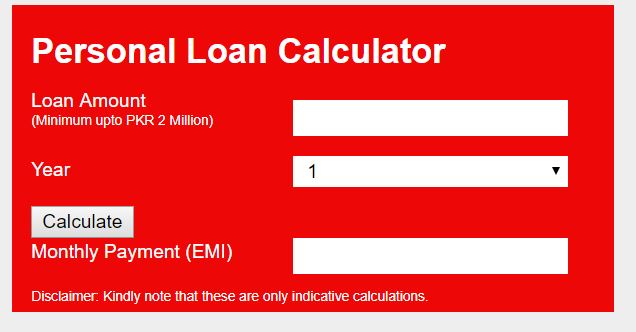

MCB Personal Loan Calculator:

MCB Bank Pakistan Personal Loan Calculator online will help you to find the Loan Amount and Monthly Payment (EMI) that you will have to pay according to the years set in that tenure you will pay your loan.

Use the link to find the MCB Personal Loan Calculator online.

MCB Personal Loan is an excellent choice for those in need of quick financial assistance. With its flexible terms, wide eligibility, and easy application process, it stands as a reliable option for your immediate financing needs. Remember, all loans are processed and approved as per MCB Bank Limited’s sole discretion by regulations and the bank’s approved policies and procedures. If you’re looking for a personal loan, MCB might just be the answer you’re looking for.